Drum-Type Cooking Robots Fuel China's Catering Automation Boom, Market Set to Hit 3.7B Yuan in 2025

China's drum-type cooking robot sector is experiencing explosive growth driven by rising demand for automation in the catering industry, with market data showing accelerating adoption among chain restaurants, corporate canteens, and group meal providers. The country's overall cooking robot market is projected to reach 3.7 billion yuan ($508 million) in 2025, surging to 11.7 billion yuan by 2030, with drum-type models emerging as a key growth driver for commercial applications.

Massive Orders from Catering Giants

Leading food and beverage brands are placing large-scale orders for drum-type cooking robots, drawn to their high capacity and energy efficiency. Anhui-based restaurant chain Xiaocaiyuan plans to purchase 3,000 drum-type units with 150 million yuan raised from its IPO, following successful trials in 200 of its outlets where the robots handle dishes like shredded potatoes and assist with vegetable washing. 老乡鸡 (Laoxiangji), another major chain, has deployed automated equipment including drum-type cookers in 388 restaurants and aims to add 3,000 more units to cut labor costs and standardize food quality.

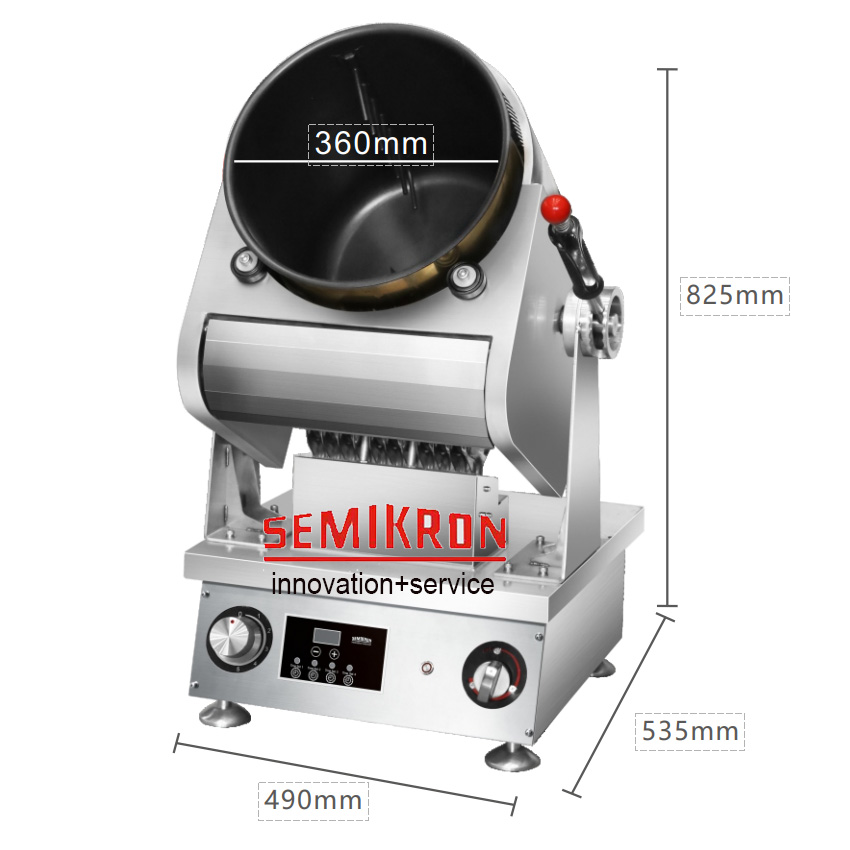

Technology Advantages and Cost Savings

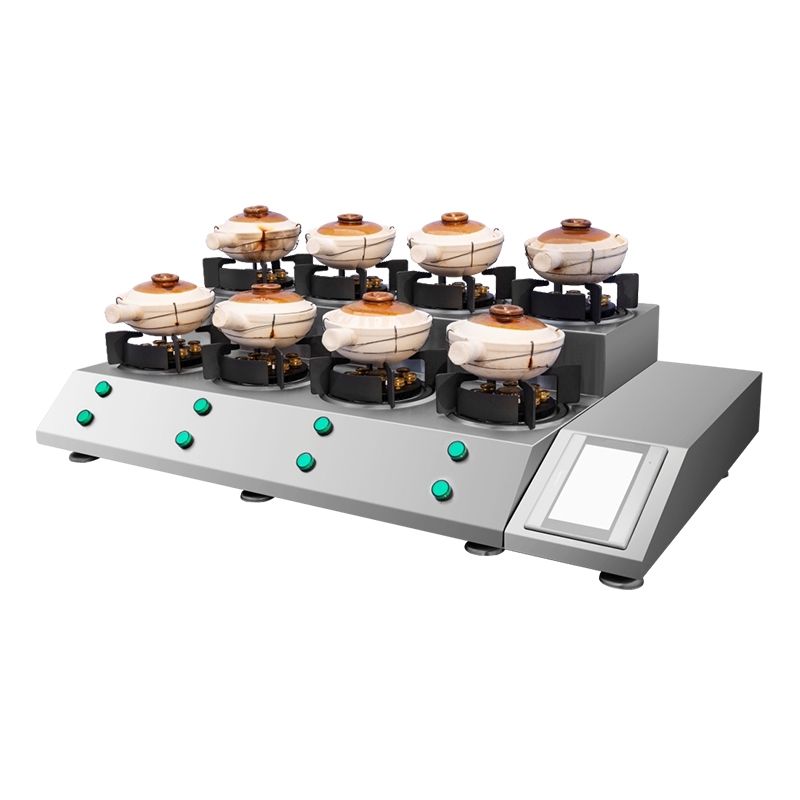

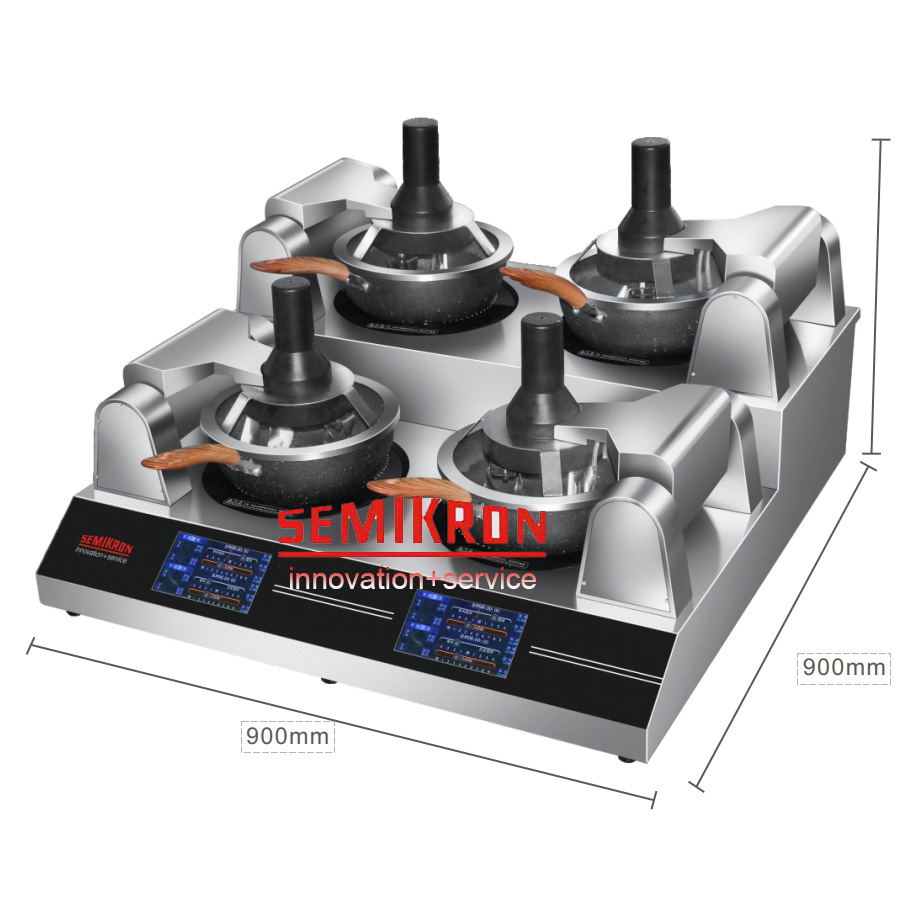

Drum-type models stand out in commercial settings due to their large capacity and energy efficiency, making them ideal for group meals, corporate canteens, and delivery-focused kitchens. Hangzhou Chubao Technology, a key manufacturer, has installed three of its drum-type systems in Zhejiang University City College's canteen, where a single operator can manage multiple units simultaneously.

These robots deliver measurable cost reductions: Seasonings usage drops 10-30%, energy consumption falls by 20%, and labor costs are cut by 30-40%, according to Zhang Shijie, General Manager of Chubao Technology. "We've transformed vague traditional cooking techniques into precise digital recipes," Zhang explained, noting the integration of drum-type cookers into full-chain smart kitchen solutions that include robotic arms and food safety monitoring systems.

Market Expansion and Competitive Landscape

Sales of commercial cooking robots are soaring, with Tineco—owned by ECOVACS—recording 1,000 unit sales in the first half of 2025, double its 2024 full-year total. The brand now partners with over 200 catering businesses, predicting a fivefold annual growth rate. Foshan Rencore Robotics expects to fulfill nearly 10,000 orders this year, up from 3,000 in 2024.

Drum-type robots typically range from 30,000 to 200,000 yuan, targeting professional users distinct from consumer-oriented tray-type models priced under 10,000 yuan. This segmentation reflects the market's evolution toward scenario-specific solutions, with closed-type robots dominating central kitchens and planetary models favored by casual dining chains.

Industry experts attribute the boom to pressing catering industry pain points: labor costs account for 25-35% of total expenses and continue rising, while consumers increasingly demand freshly cooked food. "Drum-type robots address both challenges by maintaining quality consistency while slashing operational costs," said Leng Ling, CEO of Tineco Intelligence, noting the sector's transition from early exploration to large-scale adoption.